As I have learned more about what to look for in technology-oriented investment opportunities, I have begun to realize that investing in businesses with strong network effects is a way to skew the odds in your favor. Knowing little about network effects, I recently did a deep dive and the result is this three-part series on network effects.

In last month’s essay, we explored network effects and how they work. There were three key takeaways:

-

Network effects are one of the most powerful methods of value creation in today’s digital world [1]

-

Network effects occur when the value of a business or product increases with every new user, or a rise in usage

-

The goal of every business with network effect capabilities should be to reach critical mass [2]

This month’s essay will focus on the different types of network effects.

While numerous different network effects exist, we will explore seven in two different categories based on their strength and utility. [3]

Direct network effects

-

Physical networks

-

Protocol networks

-

Personal utility networks

-

Personal direct networks

-

Market networks

Two-sided network effects

6. Two-sided marketplaces

7. Two-sided platforms

Finally, this essay is intended to be an easy-to-use manual and a living document on network effects—it is not the final word on the topic.

Direct network effects

The first overarching category of network effects is direct network effects, which are the strongest and simplest type. An increase in the usage of the product, either by the same users or new ones, leads to a direct increase in its value.

We will explore five direct network effects.

1. Physical Networks

Physical network effects are tied to physical objects. The nodes and links are all physical things. Examples include cities (nodes) and highways (links) or telephone towers (nodes) and wires (links).

Physical network effects are powerful because they have high barriers to entry, often in the form of a large upfront investment. [4]

Let’s use the telephone industry as an example. To compete with a telephone and communications service provider, you would first need to spend time and money to establish telephone infrastructure (e.g., telephone lines) across the country. Building infrastructure to serve a limited area provides minimal value to customers. What use is a telephone if you can’t call anyone? It is only after spending time and money to build country-wide infrastructure that you would start to get customers.

The high barriers to entry cause physical network effect businesses to be highly defensible (i.e., harder for competitors to take market share) and become monopolies over time. As a result, they are typically government controlled or regulated. Transportation, infrastructure, sewage, cable and electricity are all examples of physical network effects. The fact that they are monopolies is often why these businesses have terrible customer service. With no competitors for customers to turn to, these businesses have no incentives to improve.

2. Protocol Networks

Protocol network effects occur when a specific technology becomes the widely accepted protocol used to solve a problem. This is an abstract definition, so it is best to use an example to clarify it.

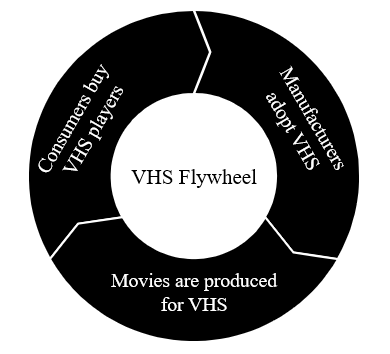

The video home system (VHS), used to play cassette tape movies in the 80s and 90s, is a good example of a protocol network effect.

JVC invented VHS in Japan in the 1960s. JVC convinced Panasonic and Sony, two of Japan’s largest electronics manufacturers, to adopt VHS technology. Once it was accepted by the largest electronic manufactures, it quickly became the standard protocol.

As more manufacturers adopted VHS, it captured more market share. This increase in market share led to more movies being produced for VHS and more customers buying VHS players. The result of this flywheel was that VHS became the standard protocol until the DVD came around decades later.

While protocol networks are powerful, the creator of the technology often captures only a fraction of the value created. For something to become the standard protocol it is often required to be open sourced, cheap, and highly marketed to drive adoption.

3. Personal Utility Networks

Personal utility networks are tools or products that people use to interact with their personal networks. The best examples are communication platforms such as Zoom, WhatsApp, Slack, and iMessage.

Personal utility networks have four distinguishing features:

-

They are typically essential to the users’ personal or professional lives

-

Users tie their personal identities to the technology, product, or platform

-

Usage is private in nature

-

These platforms reach critical mass early [5]

People use these tools to interact with their personal networks—their co-workers, spouses, friends, etc. The importance of these relationships makes these platforms critical to user’s professional and personal lives. Because personal networks are tied to our real-life relationships, we use our real identifies. Our WhatsApp, or Zoom accounts don’t have fake names. These relationships are often intimate in nature and the conversations are often private. Zoom calls, text messages, etc. are not meant for broad public display. Finally, these products are entirely dependent on critical mass. The underlying platforms provide little to no value to users unless there is another person on the platform.

4. Personal Direct Networks (Social Networks)

Products such as Facebook, Instagram and Twitter are personal direct networks. They are like personal utility networks, but they differ in two major ways:

-

They are less critical

-

The communication / experience is more public

Personal utility networks are more critical than personal direct networks. You use Instagram to show off your recent vacation and Zoom to coordinate a project at work. As a result, personal direct networks are less “sticky”. You hear of people taking a social media break and deleting Instagram, but no one ever deletes iMessage.

Personal direct networks are more public than personal utility networks. There is a difference between texting your partner on WhatsApp and Instagramming your vacation to Miami. In both cases your audience is your personal connections (to an extent), but the nature of how the products are used is different. The first is a “must-have” private experience. The second a “nice-to-have” public experience. [6]

Personal direct networks are nonetheless powerful. Humans have a tribal need to connect with others and personal direct networks allow us to extend our most important friendships and relationships online.

5. Market Networks

A market network blends elements of a marketplace (more details below) and a personal direct network to help provide a service.

Marketplaces, such as Uber and TaskRabbit, focus primarily on one-off transactions. The demand and supply sides don’t build long-term relationships with each other, and the transactions are small ticket items with minimal complexity (e.g., a ride from point A to B).

Personal direct networks (social networks like Instagram) are used to communicate and build relationships. Commerce is not the core purpose of a social network.

A market network is the best of both worlds. What is unique about market networks is that by mixing elements of a marketplace and a social network, the services provided can be complex long-term projects.

Here’s an example for clarification.

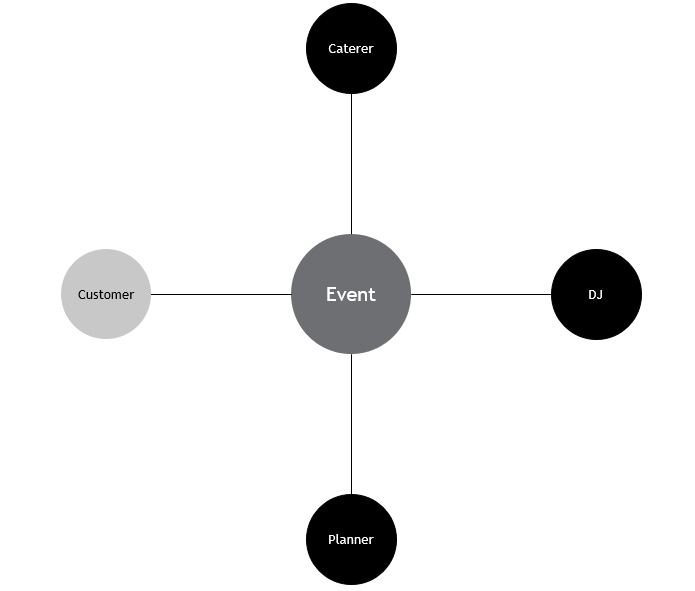

HoneyBook is a market network for the events industry. An event planner can build a HoneyBook profile that serves as their professional home (supply side). They use the HoneyBook platform to send proposals to interested customers (demand-side). They also connect with other professionals on HoneyBook who are involved with events, but who are not event planners (e.g., caterers and DJ). These professionals all have profiles on HoneyBook (social network) and team to serve customers.

What is most intriguing about marketplace networks is their ability to create platforms that offer complex services. For example, it is a matter of time before a marketplace network is created for buying a company. We are only in the first inning of marketplace networks.

Two-Sided Network Effects

The second overarching category of network effects is two-sided networks, which are often called “supply and demand” networks.

The distinguishing characteristic of two-sided networks is that they have two different classes of users—supply-side and demand-side—who come to the network for different reasons. This results in the networks having both direct and indirect network effects.

Direct network effects:

In a two-sided network, each new supply-side user directly increases the value of the network to the demand-side, and vice versa.

Consider a mall. Each new store (supply-side) directly adds value to consumers (demand-side) by increasing the supply and variety of goods in one location. In the digital world, the same effect is seen but with software instead of physical locations.

The direct negative effects of two-sided networks are less obvious, and they are best seen by examining how the same side interacts with each other. Airbnb and Uber provide good examples.

The more hosts (supply side) there are on Airbnb, the more competition each host has for guest dollars. An increase in hosts (supply side), has a negative network effect for all other hosts.

The same is true of Uber. An increase in riders (demand side) leads to surge pricing for all riders.

Indirect network effects:

However, the indirect benefits of two-sided networks typically outweigh the direct negatives. Going back to the mall example, what attracts shoppers to the mall is all the shopping options they have. If there were only one or two stores at the mall, fewer shoppers would shop there. Ultimately, what is most valuable to the stores is having a concentrated area where consumers come to spend dollars. This same logic applies to digital marketplaces.

We will explore two types of two-sided networks: two-sided marketplaces and platform marketplaces.

6. Two-Sided Marketplaces

Two-sided marketplaces are made up of buyers and sellers. Once a two-sided marketplace (e.g., Craigslist or eBay) is established, it is difficult to disrupt. Buyers are there for the sellers and sellers are there for the buyers. To disrupt them, both buyers and sellers need to find a better option simultaneously, or else no one moves.

The photo above compares Craigslist in 2003 and 2021. Virtually nothing has changed; the product and website have remained almost identical, yet people continue to use Craigslist. This is because what drives most of the value in two-sided marketplaces is the network—not the product. The team at Craigslist doesn’t need to upgrade the website or product experience because it really doesn’t matter.

The one major weakness in marketplaces is “multi-tenanting”. Multi-tenanting refers to when the supply side or demand side uses numerous platforms to transact. For example, nothing prevents people from selling their products on Craigslist and eBay simultaneously. To prevent this, marketplaces need to increase switching costs and build “lock-in”.

7. Two-Sided Platforms

Two-sided platforms are like two-sided marketplaces in that they have demand side (users) and supply side (developers). What differentiates the two types of network effects is that the value generated by two-sided platforms is highly dependent on the platform itself.

On a two-sided platform, the supply side creates products for users that are available solely on the platform. A good example is iOS. iOS is the operating platform that allows app developers (supply side) to create products that iOS users (demand-side) use. Microsoft OS, Xbox and PlayStation are other examples of two-sided platforms.

Marketplaces and platforms also differ regarding the source of their value. Platforms provide value independent of network effects to a much larger degree than marketplaces do. Take the iPhone for example. While iPhone users benefit from platform network effects (e.g., an army of developers creates apps for them to use), they are also attracted to the iPhone because of its design, brand, and technical capabilities.

Platforms are also susceptible to multi-tenanting. An app developer can launch a product on iOS or Android. Game developers can produce the same game for Xbox and PlayStation without consequences.

—

The above seven descriptions of different types of network effects are intended to be a starting point. There are other types of network effects (e.g., data, social, etc.) that we did not touch on. Further, network effects are complex and constantly evolving topics. Understanding them leads to practical business decisions but requires continually revisit the topic.

For part three, we will look at a select group of companies utilizing network effects to see how they did it. draw key learnings and insights.

Notes, Inspirations & Additional Readings

-

If you want to dig deeper, I would recommend the following sites to get you started: NFX, A16Z, Metcalfe’s Law

-

Thanks to Kerri for their review and feedback.

[1] According to a study by James Currier, a four-time CEO and Silicon Valley VC, network effects have been responsible for ~70% of all value (measured in $) created by technology firms since 1994.

[2] Critical mass refers to the point where the value of the network exceeds that of the product or service for the user.

[3] Numerous other types of network effects (e.g., data, social, etc.) were omitted from this essay. My focus was on the strongest network effects from a digital business perspective.

[4] It is difficult for new competitors to compete in the same market.

[5] Products like Zoom have minimal underlying value if there are no other users. This results in the product value being surpassed by network value the number of users is greater than one.

[6] This is generally true. There is an argument that if you are an influencer then personal direct networks become a “must have” since it is a source of your income.